Max Life Insurance Company Limited: Leading India's Non-Bank Private-Sector Life Insurance Industry

Table of Contents

Max Life Insurance Company Limited, formerly known as Max New York Life Insurance Company Limited, stands as a prominent entity in the Indian life insurance sector. Headquartered in New Delhi, this company has earned the distinction of being the largest non-bank private-sector life insurer in India. Established in 2000 following the liberalization of the Indian insurance sector, Max Life Insurance began its operations in 2001 and has since grown to become a significant player in the market.

Joint Venture and Ownership Structure

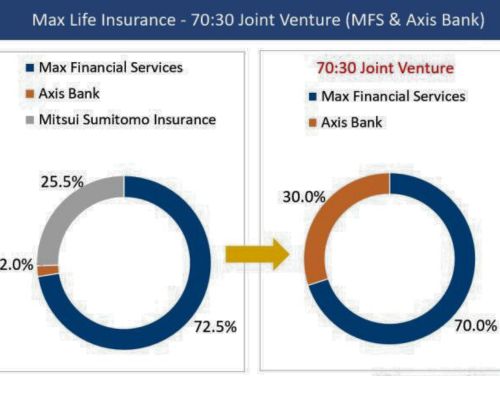

Max Life Insurance operates as an 80:20 joint venture between Max Financial Services and Axis Bank. The company is a subsidiary of Max Financial Services, which is publicly listed. This strategic partnership underscores the robust foundation and financial stability that Max Life Insurance enjoys.

Historical Background

Initially, Max Life Insurance started as a joint venture between Max Financial Services and Mitsui Sumitomo Insurance Group. At that time, Max Financial Services held a 68% stake in the company, while Mitsui Sumitomo owned 26%. The partnership with Mitsui Sumitomo led to the rebranding of the company from Max New York Life to Max Life Insurance in 2012. In 2016, Axis Bank acquired a 6% share in Max Life, further solidifying the company’s market presence.

Comprehensive Product Offeringse

Max Life Insurance provides a wide range of insurance products and services to cater to diverse customer needs. The company offers policies through both online and offline channels, utilizing distribution networks that include banks, individual agents, brokers, and corporate agents. The product portfolio includes:

- Linked Products: Investment-linked insurance plans.

- Participating Products: Policies that share profits with policyholders.

- Non-Participating Products: Policies with fixed benefits.

- Health Coverage: Insurance plans that cover medical expenses.

- Pension Plans: Products designed to provide financial security during retirement.

- Annuity Plans: Plans that offer regular income streams post-retirement.

- Child Protection Plans: Policies aimed at securing a child’s future.

- Retirement Plans: Savings and investment plans for retirement.

- Savings Plans: Products focused on saving and wealth accumulation.

- Growth Plans: Investment-oriented insurance plans.

Advertising Campaigns

Max Life Insurance has executed several impactful advertising campaigns to raise awareness about its products and the importance of life insurance. Notable campaigns include:

- Second Chance: Launched in January 2015, this campaign featured videos where individuals shared stories about how life gave them a second chance. The aim was to highlight the significance of life insurance in providing financial protection.

- Sachchi Advice: Initiated in August 2015, this television campaign emphasized the company’s commitment to offering transparent and honest advice to its customers.

Leadership and Governance

The leadership team at Max Life Insurance comprises experienced professionals dedicated to steering the company towards continued success. Key figures include:

- Analjit Singh: Chairman of Max Life Insurance.

- Prashant Tripathy: Managing Director and CEO of the company.

Conclusion

Max Life Insurance Company Limited has cemented its position as a leader in the Indian life insurance market. With a strong joint venture partnership between Max Financial Services and Axis Bank, the company boasts a comprehensive range of products and services that cater to various customer needs. Through innovative advertising campaigns and a commitment to transparency and customer satisfaction, Max Life Insurance continues to set benchmarks in the industry. For more information, visit their official website at www.maxlifeinsurance.com.

By focusing on customer-centric solutions and maintaining strong partnerships, Max Life Insurance remains a trusted and reliable name in the life insurance industry in India.

FAQ

1. What is Max Life Insurance Company Limited?

Max Life Insurance Company Limited is a leading Indian life insurance company headquartered in New Delhi. It is the largest non-bank private-sector life insurer in India, offering a wide range of insurance products and services.

2. When was Max Life Insurance founded?

Max Life Insurance was founded in the year 2000 after the liberalization of the insurance sector in India. The company began its operations in 2001.

3. What was the company formerly known as?

The company was formerly known as Max New York Life Insurance Company Limited. It rebranded to Max Life Insurance in 2012.

4. Who are the owners of Max Life Insurance?

Max Life Insurance is an 80:20 joint venture between Max Financial Services and Axis Bank. Max Financial Services owns 80% of the company, while Axis Bank owns 20%.

5. What types of insurance products does Max Life offer?

Max Life Insurance offers a variety of insurance products, including:

- Life Insurance

- Term Life Insurance

- Unit-Linked Insurance Plans (ULIPs)

- Endowment Policies

- Money-Back Policies

- Whole Life Insurance

- Retirement Plans

- Health Coverage

- Pension Plans

- Annuity Plans

- Child Protection Plans

- Savings Plans

- Growth Plans

6. How can I purchase a Max Life Insurance policy?

Max Life Insurance policies can be purchased through multiple channels, including online platforms, individual agents, brokers, corporate agents, and banks.

7. What are some notable advertising campaigns by Max Life Insurance?

Max Life Insurance has launched several significant advertising campaigns, such as:

- Second Chance: A campaign launched in January 2015 to spread awareness about the importance of life insurance by sharing stories of individuals who got a second chance in life.

- Sachchi Advice: Launched in August 2015, this campaign aimed to highlight the company’s commitment to providing transparent and honest advice to its customers.

8. Who are the key people in Max Life Insurance?

The key people in Max Life Insurance include:

- Analjit Singh: Chairman

- Prashant Tripathy: Managing Director and CEO

9. What is the relationship between Max Life Insurance and Max Financial Services?

Max Life Insurance is a subsidiary of Max Financial Services, which is a publicly-listed company. Max Financial Services holds an 80% stake in Max Life Insurance.

10. Where can I get more information about Max Life Insurance?

For more information about Max Life Insurance, you can visit their official website at www.maxlifeinsurance.com.

If you have any additional questions or need further assistance, please feel free to contact Max Life Insurance through their official website or customer service channels.