If you’re living paycheck to paycheck, dealing with credit card debt can feel like an endless cycle. It seems like no matter how much you pay, the balance just doesn’t go down. But here’s the good news: getting out of credit card debt on a low income is totally possible. It might take some time and effort, but with a solid plan, you can start working your way out of debt without completely sacrificing your quality of life.

Let’s break it down into simple steps.

Quick Summary Box

How to Stop Interest Growth & Pay Off Credit Card Debt:

Stop interest growth:Try balance transfers or negotiate for a lower interest rate.

Protect essentials: Make sure you’re paying for your basic needs first.

Negotiate with creditors: Reach out to credit card companies to lower your interest rates or explore debt settlement options.

Increase cash flow: Find ways to bring in more money, like side jobs or cutting back on non-essential expenses.

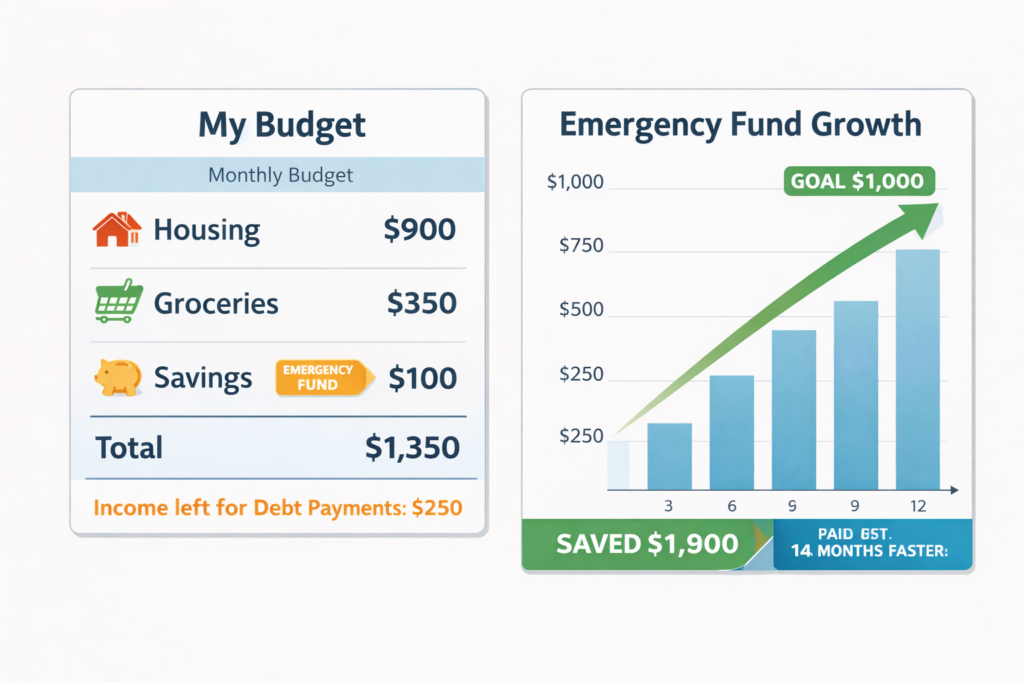

Real-Life Example:

John, who makes $2,100 per month, has $4,800 in credit card debt with an APR of 23%. He contacts his credit card company and negotiates an APR of 15%. By paying $200 per month instead of the usual $120, he saves about $1,300 in interest payments and pays off his debt 14 months earlier.

This is just one example of how negotiating your interest rate and paying more each month can make a huge difference in how quickly you pay off your debt.

Step 1: Stop Adding More Debt

The first thing you have to do to take control of your finances is very simple: just stop using your credit cards. It is tempting to just keep on swiping, especially when life gets stressful, but the last thing you want to do is add to your debt.

Here’s what you can do:

1. Make a Budget

The first step is to write down where your money is going. There are some great tools like Mint or EveryDollar that can help you track your spending. Once you see where your money is going, you can start making a plan. Cutting back on some of the unnecessary expenses will give you more money to put towards your debt.

2. Create an Emergency Fund

Even if you are living on a tight budget, it’s a good idea to try to save at least $250 to start. This will help you avoid pulling out your credit card when you have an unexpected expense. As your financial situation gets better, you can work towards building it up to 3-6 months of expenses.

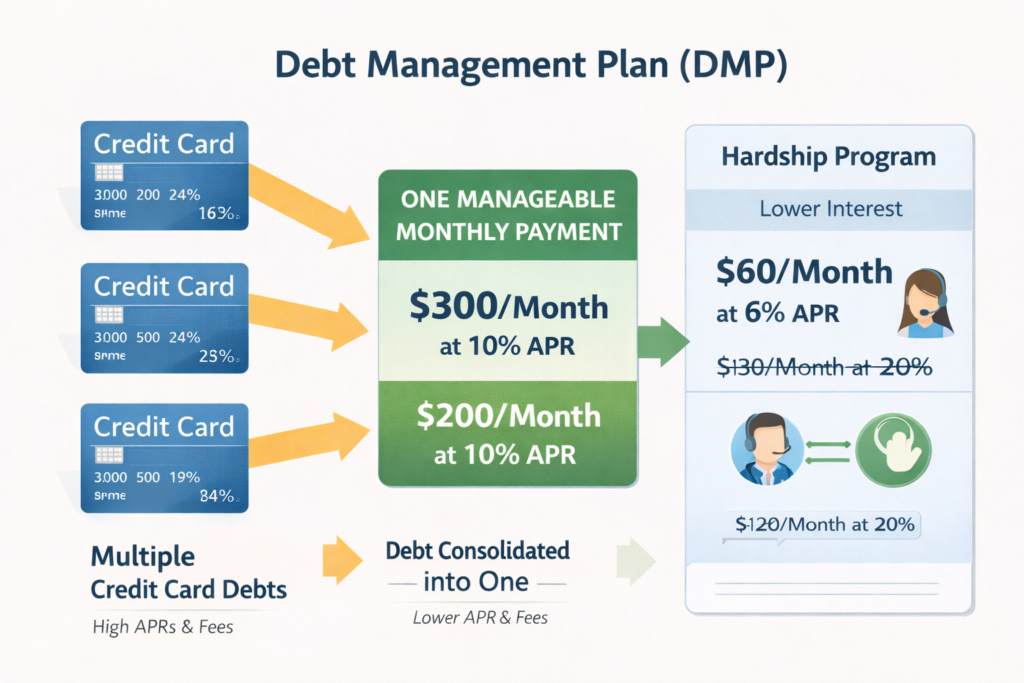

3. Use Hardship Programs

Many credit card issuers have hardship programs that can lower your interest rate temporarily or even help you defer payments for a period of time. It is worth calling your credit card issuers to see if they have hardship programs.

Step 2: Choose a Debt Repayment Strategy

Now that you have stopped adding to your debt, it is time to start paying it off. There are a variety of ways that you can attack your debt, depending on what drives you the most.

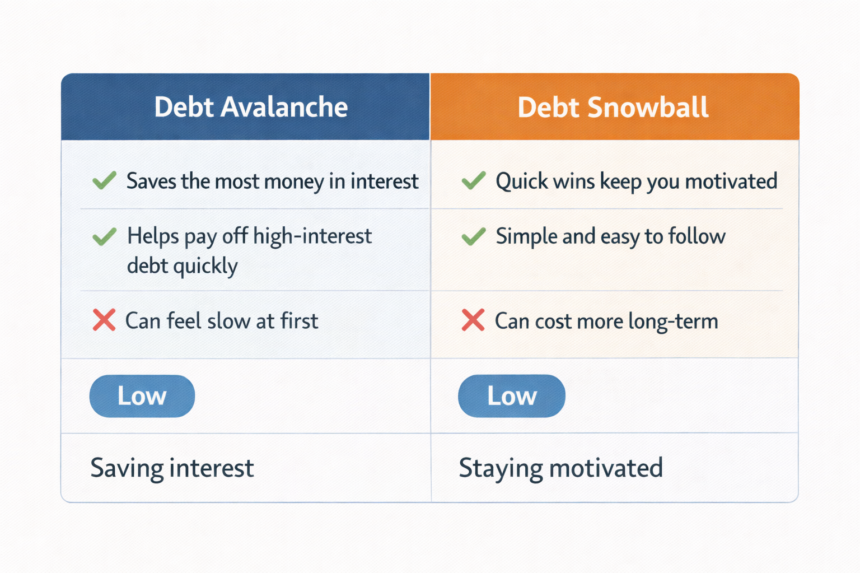

Debt Avalanche Method

This method saves you the most money over time. You focus on paying off the debt with the highest interest rate first, then move down to the next highest.

Pros:

Saves the most money in interest.

Helps you pay off debt faster.

Cons:

It can feel slow at first, especially if your smaller balances don’t get paid off quickly.

Debt Snowball Method

This one is good for people who need motivation to keep going. You pay off your smallest debt first, no matter the interest rate. Once that’s done, you move on to the next smallest, and so on.

Pros:

Quick wins keep you motivated.

Simple and easy to follow.

Cons:

It may take longer and cost more, as higher-interest debts take longer to pay off.

Balance Transfer

If you have decent credit, a balance transfer card can help lower your interest rate to 0% for a certain period. This gives you time to pay off your debt without adding more interest.

Pros:

No interest for the introductory period.

Consolidates multiple payments into one.

Cons:

There might be a balance transfer fee (usually 3–5%).

Interest rates may go up after the intro period ends.

Best Methods for Paying Off Debt

| Debt Avalanche | Saving interest | Low |

| Credit Counseling (DMP) | Very low income | Low |

| Balance Transfer | Fair credit | Medium |

| Debt Settlement | Severe hardship | High |

Step 3: Get Support and Stay Disciplined

Paying off credit card debt is hard, but you don’t have to do it alone. There are support systems available to help guide you through.

Nonprofit Credit Counseling

Organizations like the National Foundation for Credit Counseling (NFCC) can connect you with nonprofit credit counselors who will help you build a personalized plan for getting out of debt.

Look for Debt Relief Programs

Many credit card companies offer relief programs that reduce interest rates or even help reduce your debt. Ask your creditors if they have any options to make your payments more manageable.

FOR A MORE DETAILED STRATEGY,CHECK OUT OUR

[Best Way to Pay Off Credit Card Debt: A Comprehensive Guide for U.S. Consumers]

FAQ

Start by creating a budget, cutting back on non-essential spending, and focusing on the smallest debt first (snowball method). You can also negotiate with your creditors for lower interest rates or apply for hardship programs.

If you have no money, contact your creditors for help, or consider a Debt Management Plan (DMP). You can also look for ways to increase your income through side jobs or freelance work.

To pay off credit card debt quickly with a low income, cut back on your expenses, increase your income, and use the debt avalanche or snowball method. You can also consider balance transfer cards to save on interest.

The “Debt Settlement” Trap (Warning)

Debt settlement might sound like an easy way out, but it should only be considered as a last resort. While it can reduce your total debt, it can seriously harm your credit score. Be aware that debt settlement companies may charge high fees, and it might take a long time to fully rebuild your credit.

Final Thoughts

It’s not easy to pay off credit card debt on a low income, but it is definitely possible. With a little bit of planning, negotiating, and a whole lot of hard work, you can pay off your debt and start working towards a brighter financial future.

Just remember to keep your head up and keep pushing forward. There is definitely light at the end of the tunnel, and you have the power to make it happen.

Disclaimer:

The information provided in this article is for educational purposes only and should not be considered as financial advice. Always consult with a financial advisor or credit counselor before making any significant decisions regarding debt repayment or financial strategies. The strategies discussed may not be suitable for everyone and results may vary depending on individual circumstances.