If you’ve just discovered that your bank account is frozen, you’re probably feeling a mix of panic and confusion. I’ve seen this reaction many times. Usually it starts with a declined card, followed by a vague message in online banking, and then a frustrating call to customer support that doesn’t explain much.

Let me say this upfront:

In most cases, a frozen bank account in the USA is not a punishment. It’s a control measure. Banks freeze accounts to protect themselves, comply with federal law, and reduce risk. Unfortunately, that protection often comes at the customer’s expense—at least temporarily.

If you’re searching for “bank account frozen what to do usa”, this guide will walk you through what’s actually happening, what steps matter, and what actions quietly make things worse.

What a Bank Freeze Really Means (Not What Most People Assume)

A frozen bank account means your financial institution has restricted access to your funds while reviewing a compliance or risk issue. The money is still yours. The bank has not “taken” it.

Under laws such as the Bank Secrecy Act and Know Your Customer (KYC) regulations, banks are required to pause activity when certain triggers appear. These decisions are often automated at first, then reviewed by humans later.

When an account is frozen, you may notice:

Withdrawals fail

Transfers are blocked

Debit cards stop working

Deposits still arrive but can’t be used

That last point surprises many people. It happens often.

Why This Happens So Suddenly to First-Time Account Holders

In my experience, most first-time users are caught off guard because U.S. banks don’t operate on trust—they operate on patterns.

You don’t need to do anything illegal to trigger a freeze. You just need to do something unexpected.

Banks prioritize risk mitigation. That means they freeze first and explain later. It’s frustrating, but it’s how the system works.

The Most Common Reasons Accounts Get Frozen in the USA

Compliance-Triggered Activity Reviews

This is the most common situation I deal with.

Banks monitor behavior. Not intent.

A sudden large deposit. Rapid transfers. New payees. International activity. Any of these can trigger a review.

I’ve often seen accounts frozen simply because the activity didn’t match historical patterns.

Identity and Verification Issues

KYC rules require banks to keep customer records current. If your ID expires, your address can’t be verified, or your SSN/ITIN doesn’t match internal records, access may be restricted until verification is complete.

Suspected Fraud or Disputes

If a transaction is flagged as potentially unauthorized, banks may lock the account to prevent further losses. Even when the customer is the victim, the freeze still happens.

Legal or Government Holds

Court judgments, IRS tax levies, and child support orders require banks to freeze accounts by law. In these cases, the bank has no flexibility.

AML Reviews Under Federal Law

Anti-Money Laundering reviews are mandated. Even legitimate funds can be held if the source isn’t immediately clear or well-documented.

Bank Account Frozen: What I Tell Clients to Do First

I don’t believe in robotic checklists. Real cases aren’t linear. But there is an order of importance.

Confirm the Restriction Through Official Banking Channels

Log in directly to your bank’s website or app. Ignore emails or texts that don’t come from official domains.

Look for secure messages or restriction notices. Those details matter.

Contact the Bank—Calmly and Precisely

Call the official number. Be direct, not emotional.

What I advise asking:

Is this a temporary compliance review or a legal hold?

What regulation triggered the restriction?

What documentation is required to resolve it?

Your tone matters more than people realize. Banks document everything.

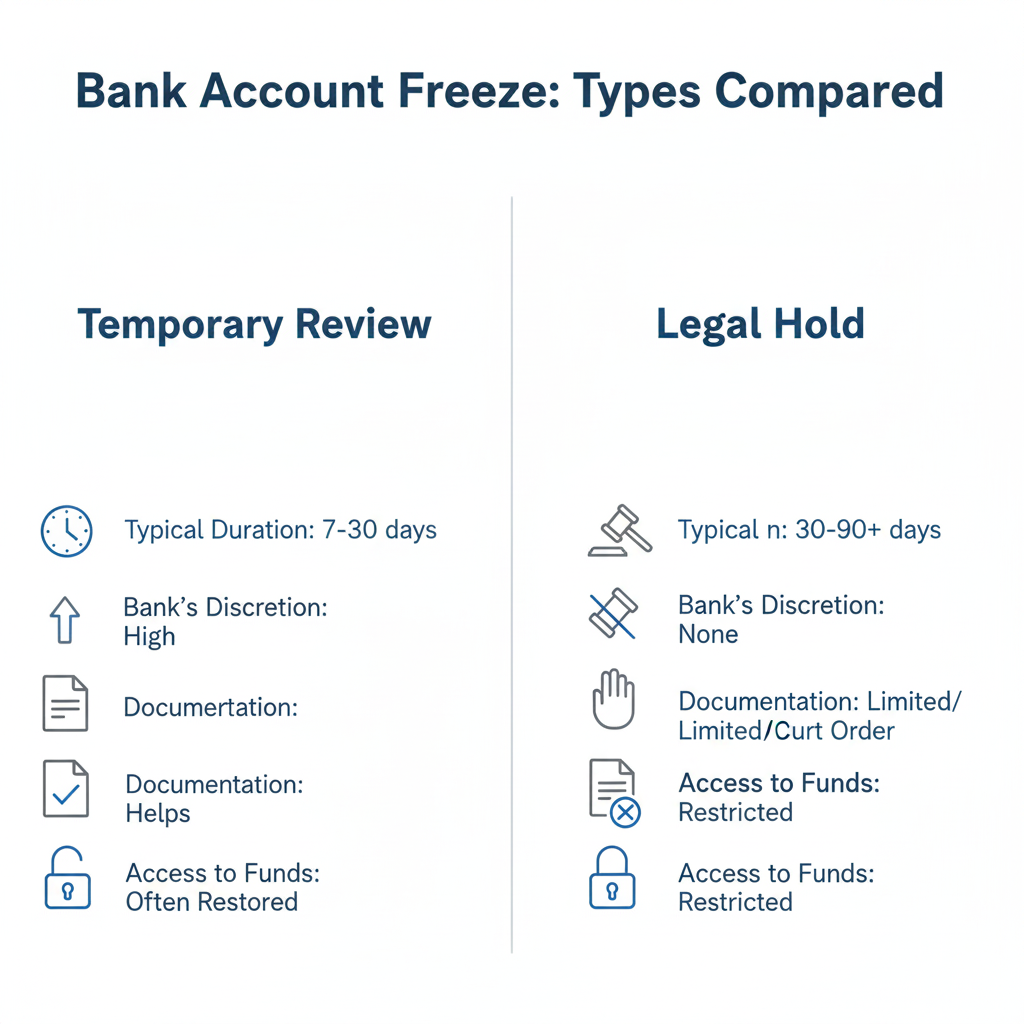

Determine the Type of Freeze

This is the fork in the road.

| Freeze Type | What It Means |

|---|---|

| Compliance or Risk Review | Usually resolvable |

| Legal or Government Hold | Requires external resolution |

Most freezes fall into the first category, even though banks rarely explain that clearly

Provide Documentation—Completely, Not Quickly

A common mistake people make is rushing incomplete documents. That resets review timelines.

Banks usually request:

Government-issued ID

Proof of address

Explanation of recent transactions

Source-of-funds documentation

Clear, organized responses reduce delays.

Ask About Limited Access

Some banks allow essential payments during reviews under internal hardship policies and Reg CC considerations. Many customers never ask.

They should.

How Long Do Bank Account Freezes Usually Last?

Based on real cases:

Around 30 days: Identity or transaction verification

Around 60 days: Fraud or dispute investigations

90 days or more: Legal orders or unresolved compliance issues

Shorter timelines are possible, but patience is often required.

A Situation I’ve Seen More Than Once

A customer deposits $18,000 from freelance work into a personal checking account. No prior large deposits. The account is frozen.

After providing contracts, invoices, and payment records, the freeze is lifted in just over three weeks.

No wrongdoing. Just a compliance review.

What Not to Do (These Actions Backfire)

Opening multiple new accounts immediately

Attempting to move funds quietly

Ignoring bank messages

Becoming aggressive with support staff

Banks evaluate behavior as part of risk assessment.

The Pros and Cons of U.S. Bank Freeze Policies

Pros

Fraud prevention

Consumer protection

Financial system stability

Cons

Poor transparency

Slow resolution

High stress for customers

Both can be true at the same time.

How to Reduce the Risk of This Happening Again

From experience, these steps help:

Keep transaction patterns consistent

Separate business and personal funds

Update identification promptly

Document large or unusual deposits

Prevention is far easier than resolution.

| Feature | Temporary Review | Legal Hold (Court/IRS) |

| Typical Duration | 7–30 days | 30–90+ days |

| Why it Happens | Suspicious activity/KYC | Tax levies, lawsuits, child support |

| Documentation Helps? | Yes (Identity/Invoices) | Limited (Needs legal resolution) |

| Bank’s Discretion | High (Bank can decide) | None (Bank must follow law) |

| Partial Access? | Often restored via phone | Extremely rare |

Reliable U.S. Resources

Consumer Financial Protection Bureau

https://www.consumerfinance.govFederal Trade Commission (Fraud Guidance)

https://www.identitytheft.govIRS Levy Information

https://www.irs.gov/businesses/small-businesses-self-employed/levy

Final Thoughts

A frozen bank account feels personal. In reality, it’s procedural.

Handled correctly, most freezes are temporary and resolvable. The key is understanding how U.S. banks operate—risk first, explanation later.

This isn’t theory. It’s how the system works.

Frequently Asked Questions (FAQ)

Yes. Under U.S. banking regulations, a bank can legally freeze an account without prior notice, especially for fraud prevention, compliance reviews, or AML concerns. In my experience, advance notice is rare because banks are instructed not to tip off customers during certain reviews.

No. Most freezes are risk or compliance related, not criminal. I’ve handled many cases where the customer did nothing wrong—only something unexpected from the bank’s perspective.

No. Deposit accounts (checking and savings) are not reported to credit bureaus. A freeze does not impact your credit score unless it leads to missed loan or credit card payments.

Often, yes. Many banks allow incoming deposits such as payroll or benefits to post, even while withdrawals and transfers are restricted. Access, however, may remain blocked until the review is complete.

If you have submitted all requested documents and heard nothing after 30 days, escalation is reasonable. At that point, you can request a supervisor review or file a complaint with the Consumer Financial Protection Bureau (CFPB).

Be careful. Opening multiple new accounts during an active review can raise additional risk flags. I usually advise waiting until you understand why the account was frozen before taking that step.

Financial Disclosure & Disclaimer

This article is provided for general educational purposes only and reflects practical experience with U.S. banking processes and consumer finance issues. It is not legal advice, tax advice, or personalized financial advice.

I am not acting as a licensed financial advisor, attorney, or representative of any bank or government agency. Banking policies, timelines, and regulatory interpretations can vary by institution and individual circumstances.

For legal matters, court orders, or tax-related freezes (such as IRS levies), you should consult a qualified attorney, tax professional, or the relevant government authority.

Always verify information directly with your financial institution or official U.S. regulatory sources such as: