People find it difficult to manage their payment obligations because credit card debt accumulates interest rates that exceed 20%. The possibility of debt repayment exists as a reachable goal that we should work to achieve. You can achieve the elimination of your credit card debt through effective methods and the development of correct mental attitudes which will help you create your financial future.

This article explains the best techniques which people can use to eliminate their credit card debts. The Debt Snowball and Debt Avalanche methods will be analyzed together with techniques which help people obtain lower interest rates while consolidating their debt. The demonstration of these methods will include practical examples which show how they function in real situations.

1. Understanding Credit Card Debt

Credit card debt becomes the most expensive type of debt because it carries extremely high interest charges. In the U.S., credit cards can have interest rates ranging from 15% to 30%. The practice of maintaining a credit card balance results in compounding interest which increases the difficulty of paying off the original debt amount

More time spent with an outstanding balance results in higher interest charges which creates the impression of being trapped inside a debt cycle. A strong strategic plan serves as the essential solution for this situation. The best part? Your credit score increases when you pay off credit card debt which also provides you with mental relief.

Source:

Experian provides valuable insight into understanding credit card debt. They explain how high interest rates and minimum payments can extend the time it takes to pay off debt. Learn more about managing credit card debt on Experian’s website.

2. Step 0: Call Your Bank (Negotiation Script)

Here’s an insider tip: Before choosing repayment solutions for your debt start by calling your credit card company to request a reduction in your interest rate. The solution provides the simplest method to decrease interest expenses while achieving faster balance repayment. A lower interest rate means you’ll be putting more money toward the principal balance instead of just paying off interest.

Negotiation Script:

“Hi, I’ve been a loyal customer for 5 years. I’m trying to pay off my balance, but the 24% APR is making it hard. Can you lower it to 18% so I can pay you back faster?”

Why This Matters:

A simple phone call can make a big difference in the amount of interest you pay. It’s one of the best first steps to saving money before using other debt repayment strategies. According to a study from NerdWallet, negotiating your interest rate is one of the easiest ways to tackle high-interest credit card debt.

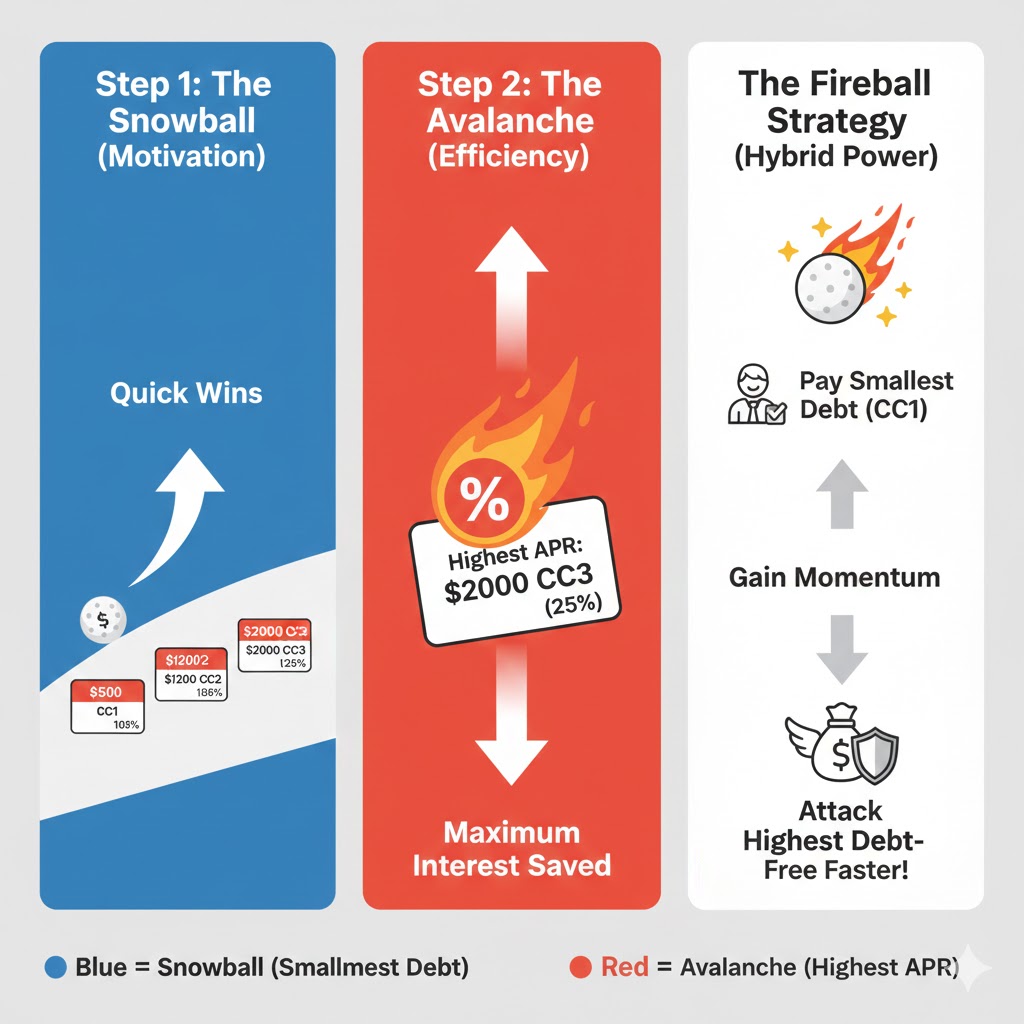

3. Debt Snowball Method: Start Small, Build Momentum

The Debt Snowball Method provides an easy yet practical solution for paying off credit card debt. The system requires you to start by eliminating your smallest outstanding balance. You will advance to the next smallest balance after you finish the previous one.

How it Works:

List your debts from smallest to largest balance.

Pay off the smallest debt while making minimum payments on the others.

Once the smallest debt is paid off, take that payment and apply it to the next smallest debt.

Example:

| Debt Type | Balance | Interest Rate | Minimum Payment |

|---|---|---|---|

| Credit Card 1 | $500 | 18% | $50 |

| Credit Card 2 | $1,200 | 22% | $60 |

| Credit Card 3 | $2,000 | 25% | $100 |

By following the debt snowball method, you pay off Credit Card 1 first, then move on to Credit Card 2, and so on.

Pros of Debt Snowball:

Quick Wins: Paying off smaller debts provides instant gratification and boosts motivation.

Simplicity: Easy to follow with minimal math.

Cons of Debt Snowball:

More Interest Paid: You might end up paying more in interest because you’re not focusing on the highest-interest debt.

Slower Progress: Larger debts take longer to pay off, which can feel discouraging.

4. Debt Avalanche Method: Pay Off the Highest Interest First

The Debt Avalanche Method is another highly effective debt repayment strategy. This approach focuses on paying off the highest-interest debt first, which reduces the amount of money spent on interest over time.

How it Works:

List your debts by interest rate from highest to lowest.

Pay off the debt with the highest interest rate first while making minimum payments on the others.

Once the highest-interest debt is paid off, move on to the next highest.

Example:

| Debt Type | Balance | Interest Rate | Minimum Payment |

|---|---|---|---|

| Credit Card 1 | $500 | 18% | $50 |

| Credit Card 2 | $1,200 | 22% | $60 |

| Credit Card 3 | $2,000 | 25% | $100 |

Here, you would tackle Credit Card 3 first, and once it’s paid off, you’d move on to Credit Card 2.

Pros of Debt Avalanche:

Saves Money on Interest: Focusing on high-interest debt first minimizes the overall interest you pay.

Faster Debt Repayment: You’ll pay off your debt faster than with the Debt Snowball method.

Cons of Debt Avalanche:

Less Motivation: It can take longer to see progress, especially if the debt with the highest interest is large.

More Complex: Requires tracking multiple interest rates, which can be cumbersome.

5. The Fireball Method (Hybrid Strategy)

Many people get confused between the Debt Snowball and Debt Avalanche methods. The Fireball Method is a combination of both strategies. You pay off the smallest balance first (for motivation) and then move to the highest-interest debt (for efficiency).

How it Works:

Start with the smallest debt (for motivation).

Then, move to the highest-interest debt to save money on interest.

This approach combines quick wins and savings on interest, making it a balanced approach to paying off credit card debt.

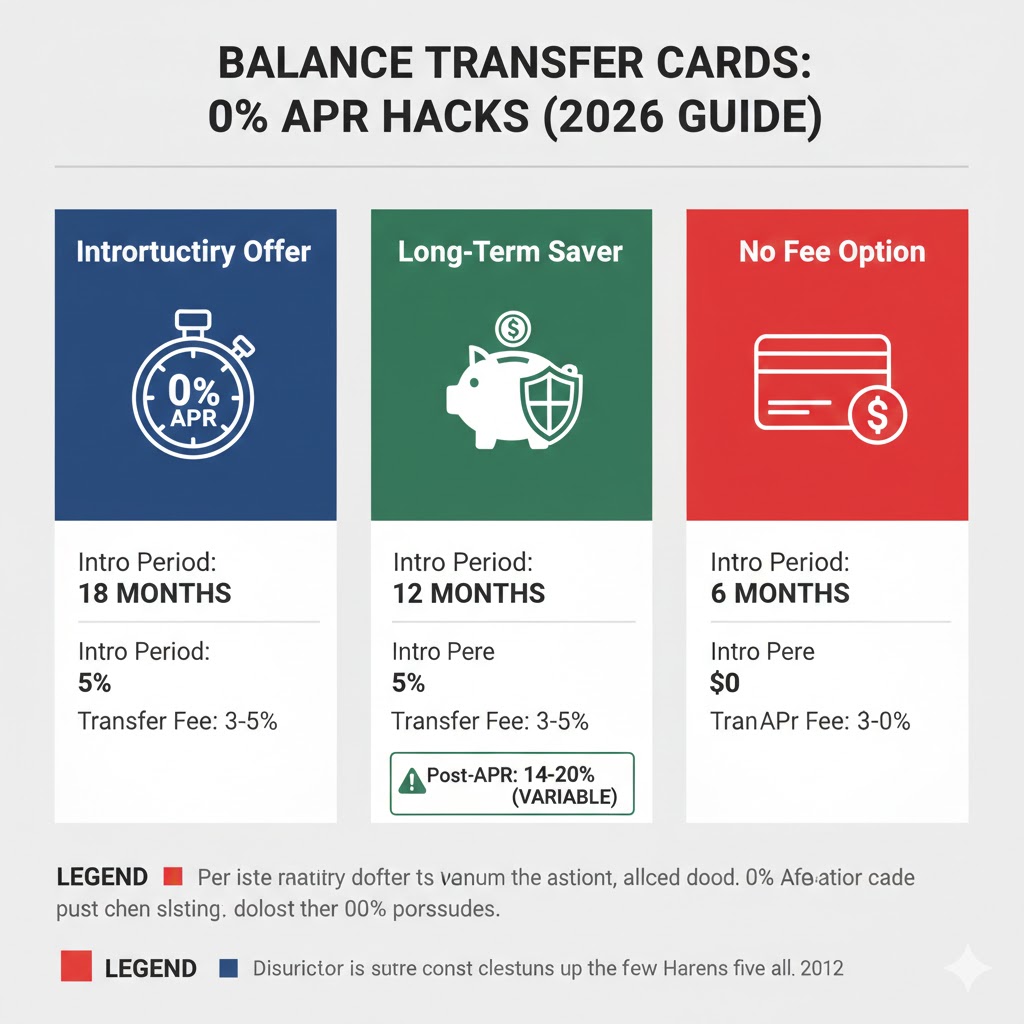

6. Balance Transfer Cards: A Temporary Solution

A balance transfer card allows you to move high-interest credit card debt to a card with 0% APR for an introductory period. This can be a great way to pay off your debt faster without accruing interest.

Warning: The Deferred Interest Trap

Be aware that if you don’t pay off the entire balance during the 0% APR period, you’ll be charged deferred interest, which means the interest is applied from the day you made the purchase.

Pros of Balance Transfer Cards:

No Interest: For a limited time, you won’t have to pay any interest on your debt.

More Payments Toward Debt: All your payments go directly toward the principal balance, rather than interest.

Cons of Balance Transfer Cards:

Balance Transfer Fees: These typically range from 3% to 5% of the amount transferred.

Short-Term Solution: You must pay off the debt within the introductory period, or you’ll face a higher interest rate.

7. Personal Loans for Debt Consolidation

A personal loan allows you to combine your existing credit card debt into a single loan which comes with a lower interest rate. Personal loans cost less than credit cards because they provide customers with fixed monthly payment plans.

Pros of Personal Loans:

Lower Interest Rates: Personal loans generally offer lower rates than credit cards.

Fixed Payments: You know exactly how much you need to pay each month.

Cons of Personal Loans:

Qualification: You may need a good credit score to get the best rates.

Loan Fees: Some personal loans charge an origination fee or early repayment penalties.

8. How to Build a Budget That Works for Debt Repayment

To successfully pay off credit card debt, you need to have a clear budget in place.

Sticking to Your Budget:

Track your income and expenses every month.

Cut unnecessary spending like dining out or subscriptions you don’t use.

Automate your payments to ensure you don’t miss any due dates.

9. Real-Life Reddit Example: How One User Tackled Their Credit Card Debt

“I felt like I was drowning. But switching to the Avalanche method saved me $800 in interest. It wasn’t easy, but seeing that high-interest balance drop was addictive.”

This Reddit user paid off $8,000 in credit card debt using the Debt Avalanche method and saved a substantial amount on interest. The key here was staying disciplined and using extra income to speed up the process.

10. Using Extra Income to Pay Off Debt Faster

If you earn extra income—whether through a side job, tax refund, or bonuses—use it directly toward paying off your credit card debt. This can accelerate your journey to being debt-free.

11. Maintaining a Healthy Credit Score

As you pay down your credit card debt, maintaining a good credit score is crucial.

Tips for a Healthy Credit Score:

Pay your bills on time.

Avoid closing old accounts (this can hurt your credit utilization ratio).

Keep your credit utilization under 30%.

12. Conclusion

Paying off credit card debt remains possible through planning and discipline and consistent efforts. You should use either the debt snowball method or the debt avalanche method or the Fireball method to repay your debt while maintaining strict payment discipline. You will achieve freedom from debt through the combination of your patience and persistent efforts.

FAQ Section:

The Debt Avalanche Method is usually the fastest way to reduce your overall debt. By focusing on the debt with the highest interest rate first, you can save money on interest, which accelerates your repayment process.

Yes, you can. By making consistent, on-time payments and reducing your debt-to-income ratio, your credit score can improve while paying off debt. Just be careful about closing old accounts, as that can lower your score.

The Debt Snowball Method focuses on paying off the smallest debt first for quick wins, whereas the Debt Avalanche Method saves more on interest by tackling the highest interest debt first. Choose the one that fits your emotional and financial situation.

Balance transfer cards can be an excellent way to pay off credit card debt without interest if used correctly. However, make sure to pay off the balance within the introductory period to avoid high deferred interest rates once the promotion ends.

Any extra income, such as side job earnings, tax refunds, or bonuses, should be used to pay off your credit card debt. This can dramatically speed up the process and reduce interest paid.

Disclaimer:

The information provided in this article is for educational purposes only and should not be considered as financial advice. Always consult with a financial advisor or credit counselor before making any significant decisions regarding debt repayment or financial strategies. The strategies discussed may not be suitable for everyone and results may vary depending on individual circumstances.