A Complete Beginner’s Guide by a U.S. Finance Expert

If you’ve ever checked your credit score and thought, “Why did my credit score change when I didn’t do anything wrong?”—you’re not alone.

I’ve worked with many U.S. consumers who feel confused, frustrated, and sometimes even scared when their credit score moves up or down without an obvious reason. In most cases, the change is completely explainable—you just weren’t told how the system works.

This guide explains what causes your credit score to change, using real-world examples, clear explanations, and practical steps you can take today.

How Credit Scores Work in the United States (Beginner Overview)

In the U.S., your credit score is a risk-assessment tool. It helps lenders decide how likely you are to repay borrowed money on time.

Most lenders rely on:

FICO Score (used by ~90% of lenders)

VantageScore (used by some banks and apps)

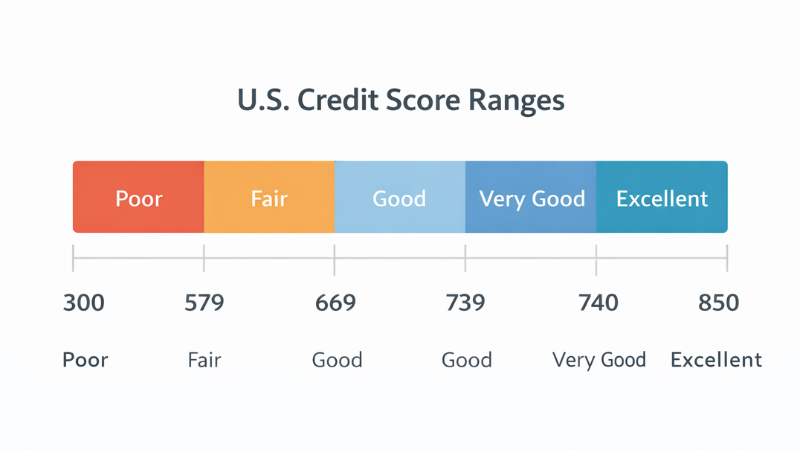

Credit Score Range

| Score Range | Meaning |

|---|---|

| 300–579 | Poor |

| 580–669 | Fair |

| 670–739 | Good |

| 740–799 | Very Good |

| 800–850 | Excellent |

Your score changes whenever new information is added to your credit report.

Most First-Time Users Experience Credit Score Changes Without Understanding Why

Most beginners believe:

Paying bills = score goes up

No late payments = score stays the same

In real situations, users often see score drops because of credit utilization, timing of reports, or new inquiries—not missed payments.

A common mistake people make is focusing only on payments and ignoring everything else.

The 5 Main Factors That Cause Your Credit Score to Change

Payment History (≈35%)

This is the most important factor.

Payment history tracks whether you pay accounts on time, including:

-

Auto loans

-

Student loans

-

Personal loans

Real Example

In my experience, a client missed a $40 credit card payment by 35 days. Their score dropped nearly 80 points, even though they had years of good history.

What hurts your score most:

30-day late payments

60-day and 90-day delinquencies

Collections and charge-offs

Late payments stay on your report for up to 7 years.

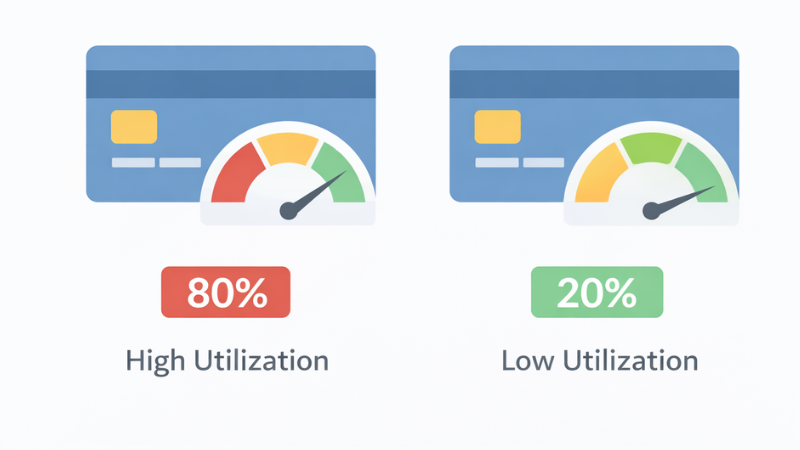

Credit Utilization (≈30%)

Example

| Credit Limit | Balance | Utilization |

|---|---|---|

| $1,000 | $800 | 80% |

| $1,000 | $200 | 20% |

Even if you pay on time, high utilization can lower your score.

Ideal utilization targets:

Under 30% = good

Under 10% = excellent

What the bank won’t tell you is that balances are reported before your due date, not after you pay.

Length of Credit History (≈15%)

This measures:

Age of your oldest account

Average age of all accounts

Common mistake

Closing an old credit card because you “don’t use it anymore.”

That can:

Shorten your credit history

Increase utilization

Result: score drops.

New Credit & Hard Inquiries (≈10%)

Whenever you apply for credit, a hard inquiry appears.

| Action | Impact |

|---|---|

| One inquiry | Small drop (2–5 points) |

| Many inquiries | Larger drop |

Hard inquiries affect your score for about 12 months.

Credit Mix (≈10%)

Credit mix looks at the variety of accounts you have.

Examples:

Credit cards

Auto loans

Student loans

You don’t need every type—but variety helps slightly.

Other Reasons Your Credit Score Changes

Reporting Timing

Different lenders report at different times. Your score can change even if nothing “new” happened.

Errors on Credit Reports

Incorrect late payments or balances can lower your score.

Paying Off a Loan

Closing a loan may cause a temporary dip because the account is no longer active.

30 / 60 / 90-Day Credit Score Timeline

| Timeframe | What Usually Happens |

|---|---|

| 30 Days | Late payment reported, utilization changes |

| 60 Days | Larger score drops if unpaid |

| 90 Days | Serious delinquencies, collections |

Positive actions like lowering balances can improve scores within 1–2 months.

Actionable Tips (Quick Skim Section)

To Protect Your Credit Score

Set automatic payments

Keep balances below 30%

Avoid unnecessary applications

Monitor credit reports

To Improve Your Credit Score

Pay balances before statement closes

Ask for credit limit increases

Keep old accounts open

Dispute errors immediately

What NOT to Do When Your Credit Score Drops

❌ Don’t panic

❌ Don’t close accounts immediately

❌ Don’t apply for multiple new cards

❌ Don’t ignore the reason for the drop

Small mistakes can cause long-term damage.

Frequently Asked Questions (FAQs)

Usually due to higher credit utilization or reporting timing.

Whenever lenders report new information—often monthly.

No. That’s a soft inquiry.

Minor issues: 3–6 months

Major damage: 1–2 years+

Most use FICO, though some use VantageScore.

Final Thoughts

Your credit score changes because your financial behavior changes—even in ways you don’t notice.

Once you understand the system, credit becomes manageable instead of stressful. In my experience, people who learn why scores change stop fearing them—and start controlling them.

Disclaimer

The information provided on USA Harmony is for educational and informational purposes only. It is not intended to be, and should not be considered, financial, legal, insurance, or investment advice.

While we strive to ensure that the information presented is accurate and up to date, financial situations vary from person to person, and laws, regulations, and financial products may change over time. Readers should not rely solely on the content published on this website when making financial decisions.

USA Harmony does not provide personalized financial advice and does not recommend or endorse any specific financial products, institutions, or services. Before making any financial, credit, banking, or insurance decisions, readers are encouraged to consult with a qualified financial advisor, lender, or other licensed professional.

All actions taken based on the information found on this website are at the reader’s own risk. USA Harmony is not responsible for any financial loss, damages, or outcomes that may result from the use of this information.