If you are new to the United States or just starting your financial journey, understanding how to build a credit score in the USA is essential. Your credit score affects almost every major financial decision — renting an apartment, buying a car, getting approved for a credit card, or even setting up utilities.

This guide is written specifically for beginners and newcomers who want to understand the U.S. credit system in clear, simple language without financial jargon.

The information in this article is based on commonly followed credit-building practices in the United States and is meant for educational purposes only.

What Is a Credit Score in the USA?

A credit score is a three-digit number that represents how reliable you are as a borrower. In the United States, lenders use your credit score to decide:

Whether to approve your loan or credit card

What interest rate you will pay

How much credit limit you will receive

Most credit scores range from 300 to 850.

Simply put, in the USA, credit score equals financial trust.

Who Creates Credit Scores in the United States?

Your credit score is created using data collected by credit bureaus and analyzed by scoring models.

Major Credit Bureaus

The three main credit bureaus in the USA are:

Experian

Equifax

TransUnion

These bureaus collect information from lenders and generate your credit report.

Popular Credit Score Models

FICO Score (used by most banks and lenders)

VantageScore (used by many free credit apps)

The rules are similar, even if the numbers differ slightly.

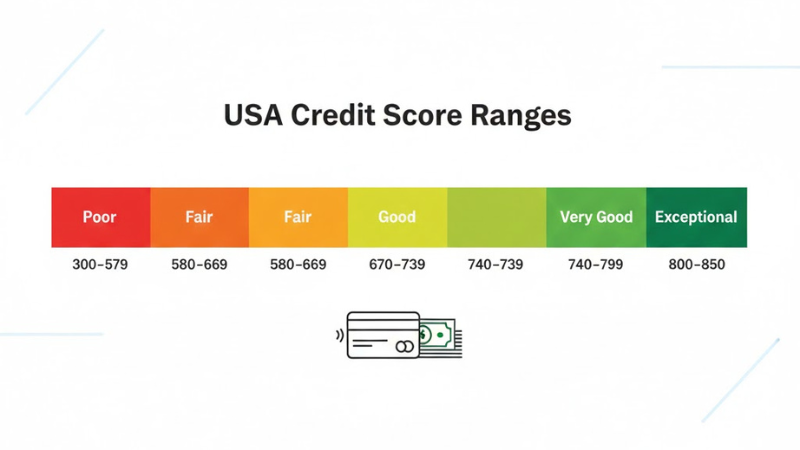

Credit Score Ranges Explained

| Credit Score | Meaning |

|---|---|

| 300–579 | Poor |

| 580–669 | Fair |

| 670–739 | Good |

| 740–799 | Very Good |

| 800–850 | Excellent |

For beginners, reaching 670+ is a strong and realistic milestone.

How Credit Score Is Calculated in the USA

Your credit score is calculated using five main factors.

1. Payment History (35%)

This is the most important factor.

Lenders check:

On-time payments

Late payments

Collections or defaults

Even a single late payment can lower your score.

In practice, setting up automatic payments is one of the simplest ways beginners protect their credit score from accidental late payments.

2. Credit Utilization (30%)

Credit utilization shows how much of your available credit you are using.

Example:

If your limit is $1,000 and you use $300, your utilization is 30%.

Best practice:

Below 30% is good

Below 10% is ideal

3. Length of Credit History (15%)

This measures how long you’ve been using credit.

Older accounts help more

Beginners start lower because time matters

4. Credit Mix (10%)

A mix of credit types helps slightly:

Credit cards

Auto loans

Student loans

Beginners do not need all of these.

5. New Credit Inquiries (10%)

Each credit application creates a hard inquiry.

Too many inquiries in a short time can temporarily lower your score.

Why Credit Score Is Important in the USA

Your credit score affects:

Renting an apartment

Car loans and interest rates

Credit card approvals and rewards

Utility deposits

Some job background checks

In the U.S., a good credit score directly impacts daily life

How to Build Credit Score in the USA From Zero

If you have no credit history, follow these steps.

1. Get a Secured Credit Card

A secured credit card is the safest way to start.

Requires a refundable deposit

Deposit becomes your credit limit

Reports activity to credit bureaus

For example, many first-time credit users start with a small secured credit card limit and focus on keeping usage low while paying every bill on time.

2. Use the Card Responsibly

Use only 10–30% of the limit

Make small monthly purchases

Avoid maxing out the card

3. Pay Every Bill on Time

Payment history matters more than anything else.

Auto-pay for at least the minimum amount helps avoid mistakes.

4. Become an Authorized User (Optional)

A trusted person can add you to their credit card.

If their account is well-managed, it may help your score.

5. Avoid Multiple Applications

Start with one card. Build history slowly.

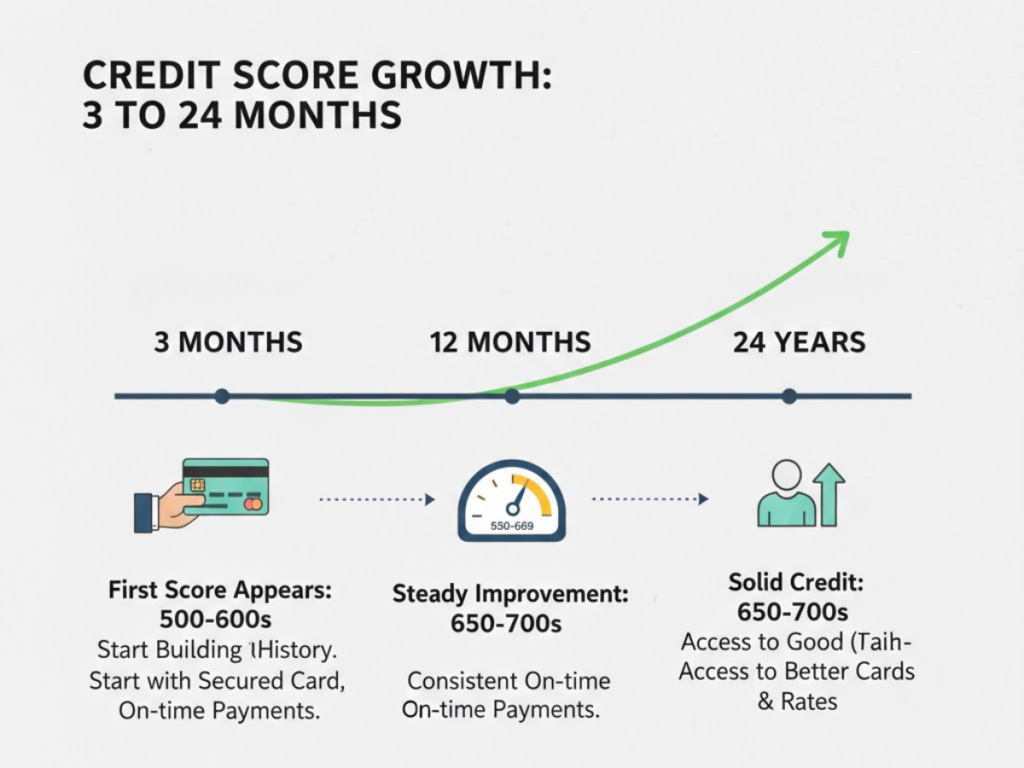

How Long Does It Take to Build Credit in the USA?

First score: 3–6 months

Good score (670+): 6–12 months

Very good score (740+): 12–24 months

Credit building rewards consistency, not speed.

Common Credit Score Mistakes Beginners Make

Missing due dates

Closing old accounts early

Applying for many cards at once

Using full credit limits

Ignoring credit reports

Avoiding these mistakes saves time and effort.

How to Check Your Credit Score for Free

Checking your own credit score does not lower it.

You can use:

Bank or credit card apps

Free credit monitoring tools

Annual credit report services

FAQs: Credit Score in the USA

Is 700 a good credit score in the USA?

Yes. A score of 700 is considered good and qualifies for most loans.

Can immigrants build credit in the USA?

Yes. Many immigrants start with secured cards or authorized-user accounts.

Does using a debit card build credit?

No. Debit cards do not affect credit scores.

How often does a credit score update?

Most scores update monthly, depending on lender reporting.

Can paying rent improve credit score?

Only if rent payments are reported to credit bureaus through a reporting service.

Conclusion

Building a credit score in the USA is not complicated, but it requires discipline and patience. Start small, pay on time, keep balances low, and avoid unnecessary applications.

If you are just starting out, consistency matters more than speed when it comes to building a strong credit score in the USA.