If you are new to the United States—or simply new to personal finance—understanding how the credit score works in the USA is essential. Your credit score affects your ability to rent an apartment, get a car loan, qualify for a credit card, and even secure certain jobs. This beginner-friendly guide explains credit scores in simple language, with practical tips you can use right away.

What Is a Credit Score?

A credit score is a three-digit number that represents how trustworthy you are as a borrower. In the United States, lenders use this score to decide:

Whether to approve your loan or credit card

How much interest rate to charge you

How much credit limit to offer

The most commonly used range is 300 to 850. Higher scores mean lower risk for lenders.

Who Creates Credit Scores in the USA?

Credit scores are calculated by scoring models using information from credit bureaus.

Major Credit Bureaus

Experian

Equifax

TransUnion

These bureaus collect your credit history and generate credit reports.

Popular Credit Score Models

FICO Score (used by most banks and lenders)

VantageScore (used by many free credit apps)

Although numbers may differ slightly, both models follow similar rules.

https://www.cnbc.com/select/guide/credit-scores-for-beginners/

Credit Score Ranges Explained

| Credit Score | Meaning |

|---|---|

| 300–579 | Poor |

| 580–669 | Fair |

| 670–739 | Good |

| 740–799 | Very Good |

| 800–850 | Excellent |

For beginners, reaching 670+ is a strong milestone.

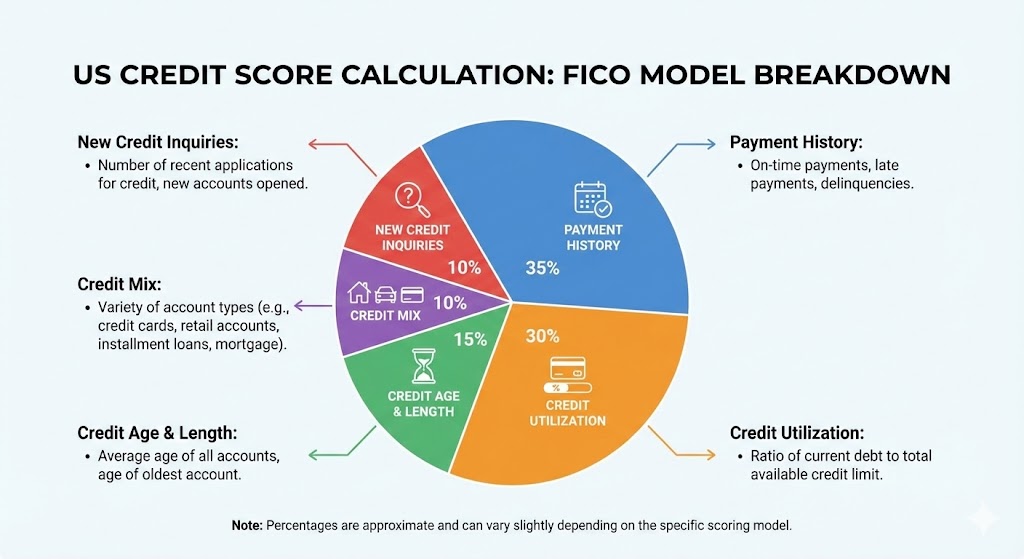

How Credit Score Is Calculated (Simple Breakdown)

Your credit score is based on five main factors. Understanding these helps you improve it faster.

1. Payment History (35%)

Did you pay your bills on time?

Late payments, defaults, or collections hurt badly.

Rule: Even one late payment can drop your score.

2. Credit Utilization (30%)

How much credit you are using compared to your limit

Example: If your credit limit is $1,000 and you use $300, your utilization is 30%.

Best practice: Keep utilization below 30% (below 10% is ideal).

3. Length of Credit History (15%)

How long you have been using credit

Older accounts help your score, which is why beginners start lower.

4. Credit Mix (10%)

Types of credit you use

Examples:

Credit cards (revolving credit)

Auto loans

Student loans

A healthy mix improves your score slightly.

5. New Credit Inquiries (10%)

Each time you apply for credit, a hard inquiry is made.

Too many inquiries in a short time can reduce your score.

Why Credit Score Is Important in the USA

Your credit score affects many parts of daily life:

Renting a home: Landlords check your score

Car loans: Lower score = higher interest

Credit cards: Better score = better rewards

Utilities: Some companies require deposits

Jobs: Certain employers review credit reports

In the USA, credit equals trust.

How to Build Credit Score From Zero (Beginners)

If you have no credit history, follow these steps:

1. Get a Secured Credit Card

Requires a refundable deposit

Works like a normal credit card

Best starting option

2. Become an Authorized User

Ask a trusted person to add you to their credit card

Their good history can help your score

3. Pay Bills On Time—Every Time

Set auto-pay for minimum balance

4. Keep Credit Usage Low

Never max out your card

How Long Does It Take to Build Credit?

First score appears: 3–6 months

Good score (670+): 6–12 months with discipline

Very good score (740+): 12–24 months

Credit building is slow but reliable.

Common Credit Score Mistakes Beginners Make

Missing due dates

Closing old accounts early

Applying for many cards at once

Using full credit limit

Ignoring credit reports

Avoiding these mistakes saves years of effort.

How to Check Your Credit Score for Free

You can check your credit score without hurting it using:

Bank mobile apps

Free credit monitoring services

Annual credit report services

Checking your own score does not reduce it.

FAQs: Credit Score in the USA

Yes. A score of 700 is considered good and qualifies for most loans.

Yes. With an SSN or ITIN, immigrants can build credit legally.

No. Only credit-based products affect credit scores.

Usually every 30 days, depending on lender reporting.

Yes, if rent reporting services are used.